Programs Help Mortgage Debt To Income

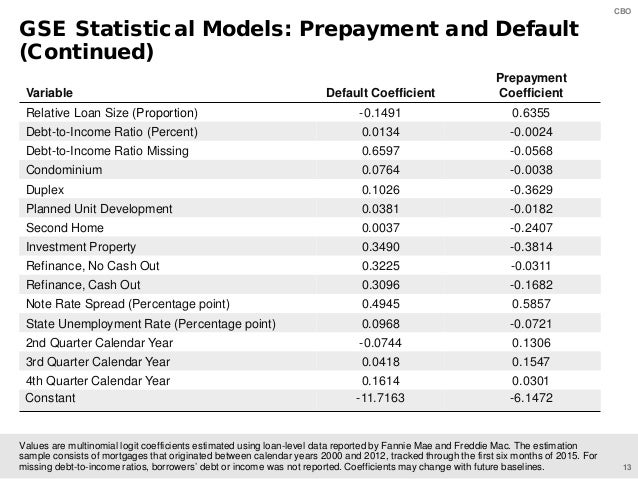

A view of your financial situation Your debt-to-income ratio can be a valuable number - some say as important as your credit score. It's exactly what it sounds: the amount of debt you have as compared to your overall income. Lenders look at this ratio when they are trying to decide whether to lend you money or extend credit. A low DTI shows you have a good balance between debt and income.

As you might guess, lenders like this number to be low - generally you'll want to keep it below 36, but the lower it is, the greater the chance you will be able to get the loans or credit you seek. Add up all of your monthly debt obligations - often called recurring debt - including your mortgage (principal, interest, taxes and insurance) and home equity loan payments, car loans, student loans, your minimum monthly payments on any credit card debt, and any other loans that you might have. The formula: Total recurring debt divided by gross income. Install os x el capitan dmg. Click on the i next to the input box of an item for definition.

Mortgage Debt To Income Ratio Calculator

Mortgage Debt To Income Ratio

Your debt-to-income ratio can be. The amount of debt you have as compared to your overall income. Check Mortgage. Rates and advice help no matter where you.